Case Study

Live Site:

https://www.pnc.com/en/personal-banking/borrowing/auto-loans/browse-auto-loans.html

Auto Lending Origination

Role: Taz Hussain, Lead UX Designer

Platform: PNC Personal Banking, Auto Lending

Timeline: 0ct 2017 - Nov 2021

Tools: Sketch · InDesign · Adobe Creative Cloud · Confluence · Jira · Design Systems · Prototyping · Accessibility Tools · HTML (basic) · User Flows · Customer Journeys · Brand Standards

Team: Cross-functional squad (UX (Research, Design System, Content), Business (Product Owner/Stake holders), Technology (Front & Backend), Testing (User Zoom, QA & UAT)

Overview

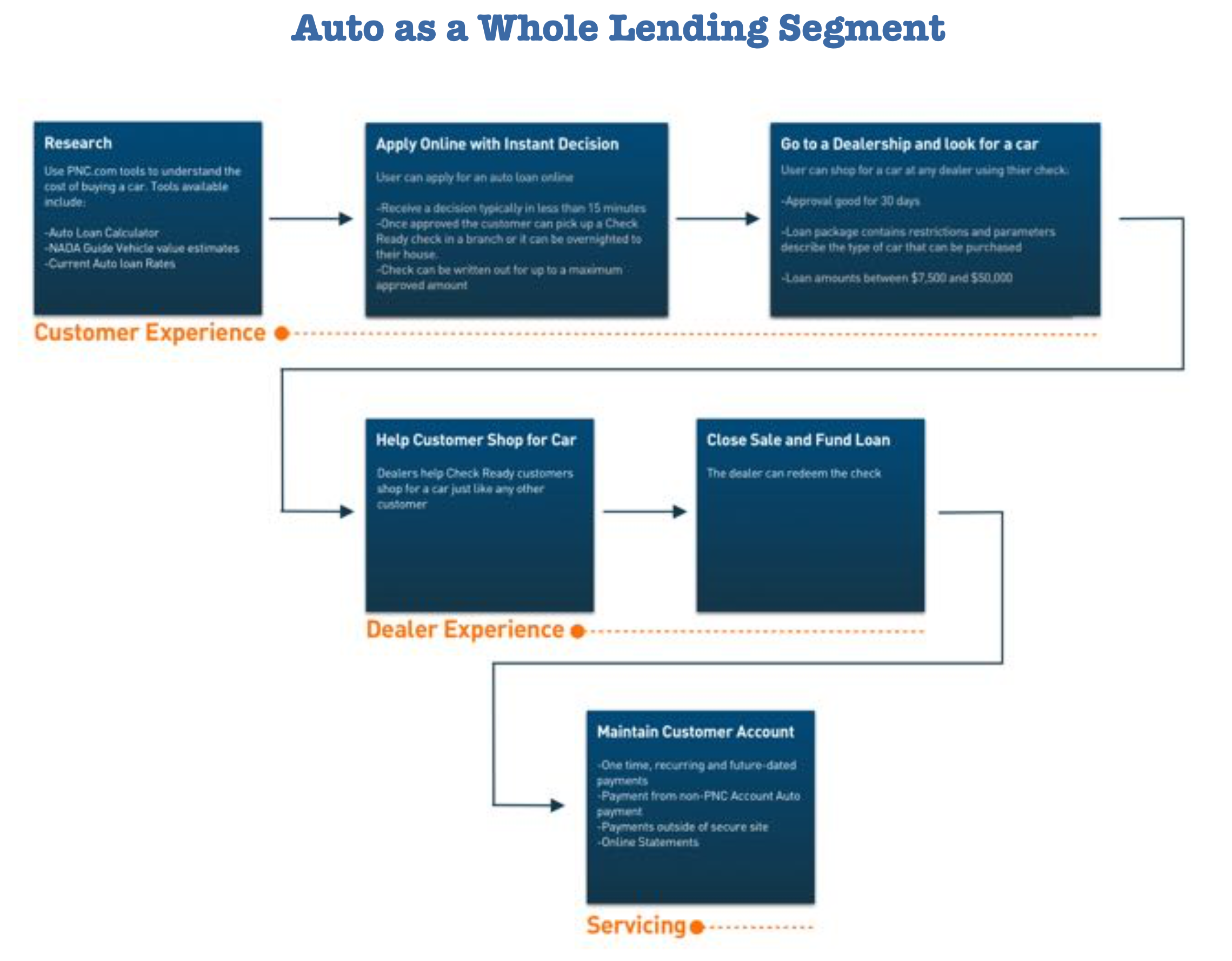

Directed a comprehensive redesign of the digital auto-lending applications for iOS and Android, delivering a streamlined and intuitive experience for customers shopping for new or used vehicles. Developed a robust MVP prototype and led iterative usability testing to ensure seamless UX/UI alignment throughout development cycles. The enhanced solution enables real-time fund transfers directly to dealers, significantly improving transaction efficiency and aligning with key product launch milestones.

The Problem

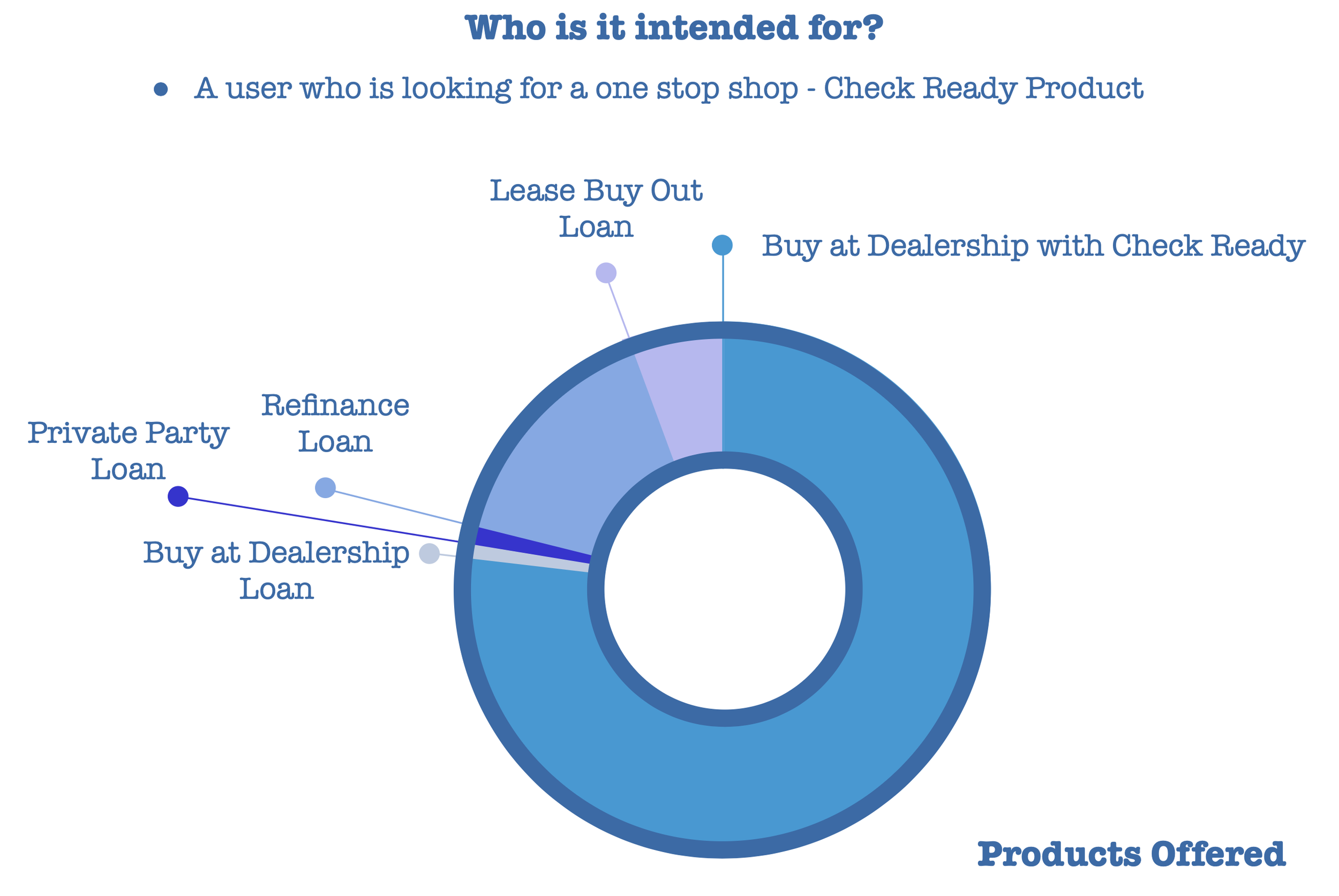

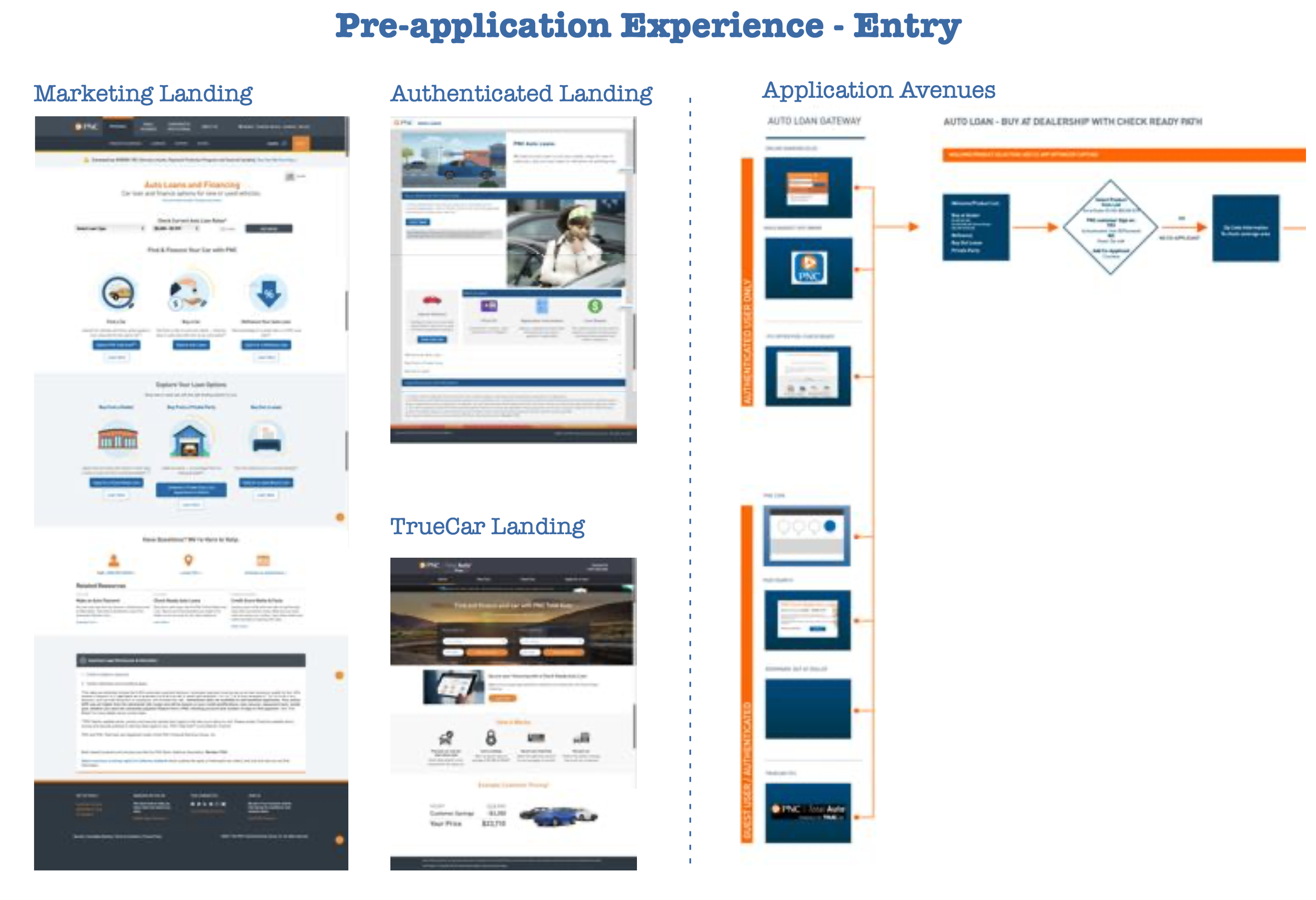

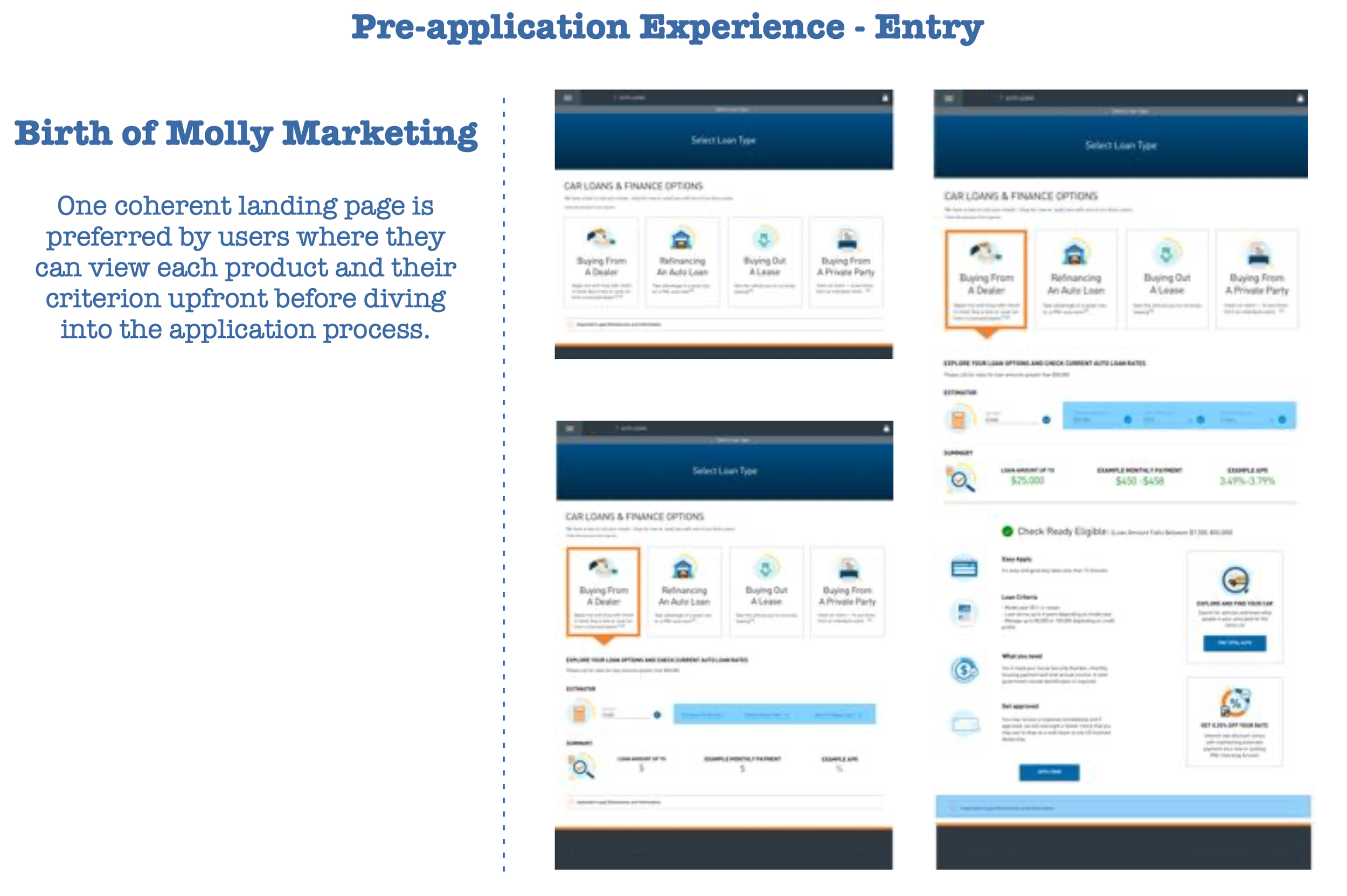

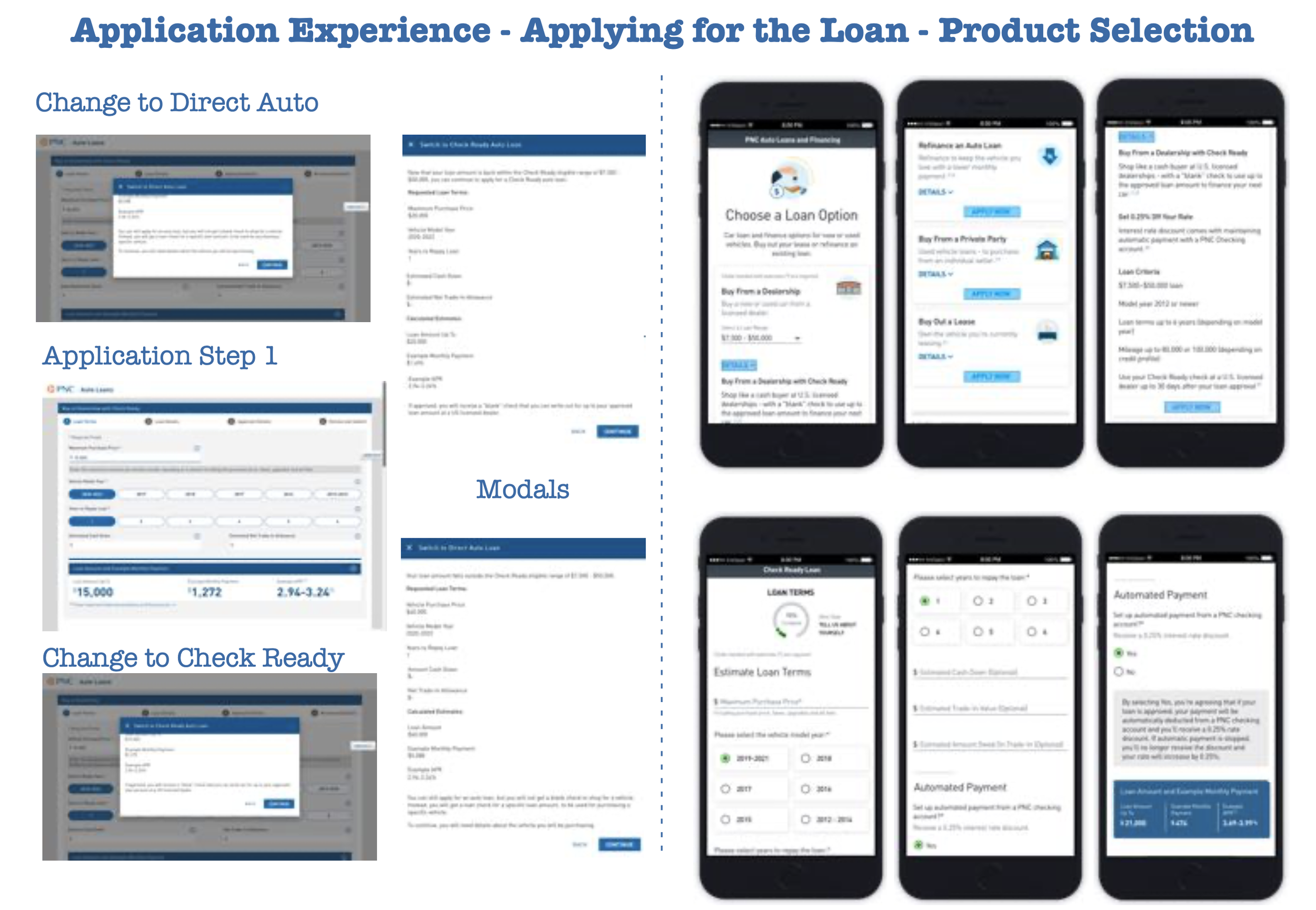

The current user experience presents multiple entry points for different products, directing prospects and authenticated users to distinct landing pages. However, the loan criteria and application requirements for each product type are not clearly articulated, resulting in ambiguity. Furthermore, the application includes a modal pop-up that inconsistently switches between the “Buy at Dealership” product and the “Buy at Dealership with Check Ready” option, creating confusion and disrupting the overall workflow.

My UX Approach

🧭 Strategic Discovery & Artifacts

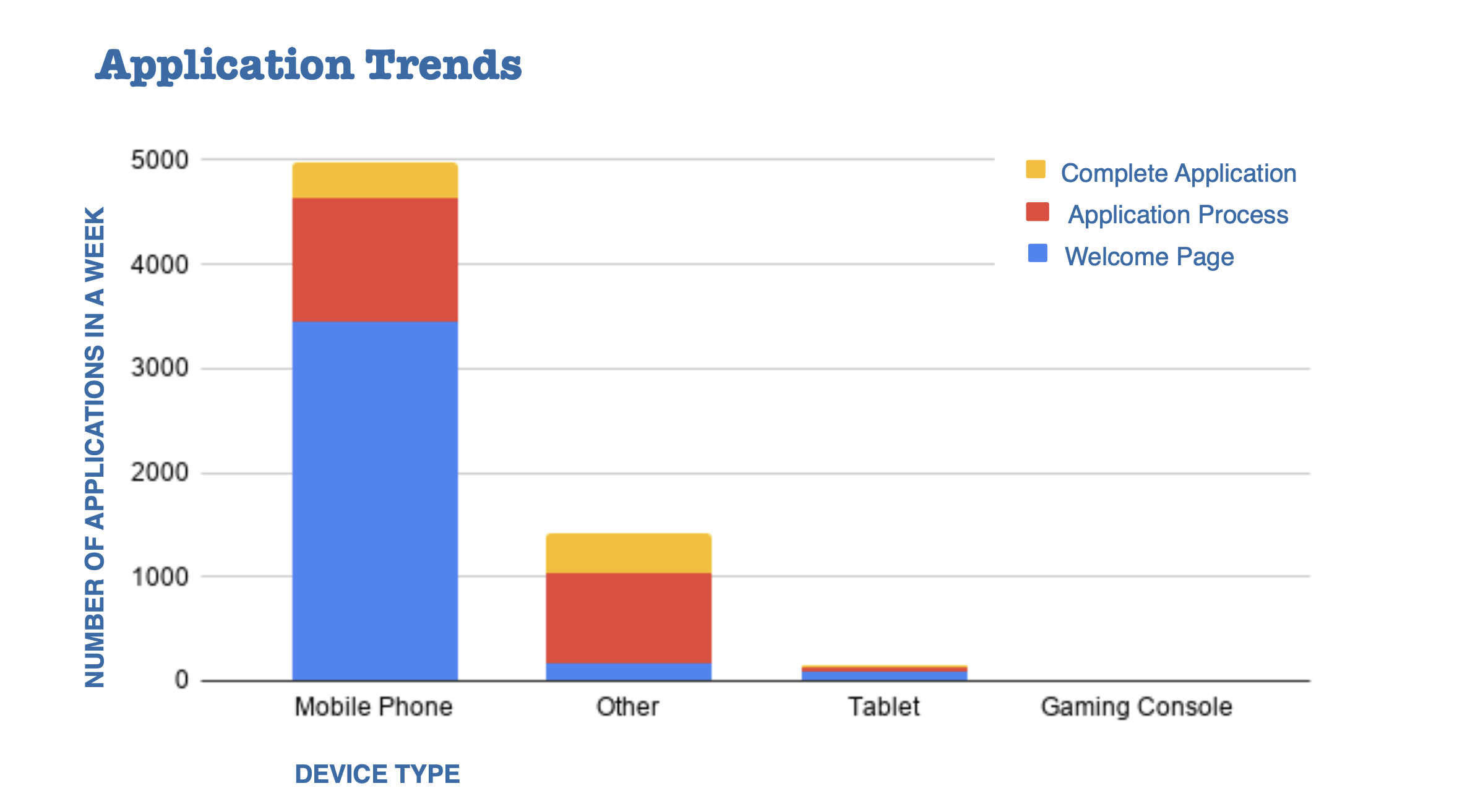

Conducted a study in how users shop for cars , what devices they use

Defined the audience

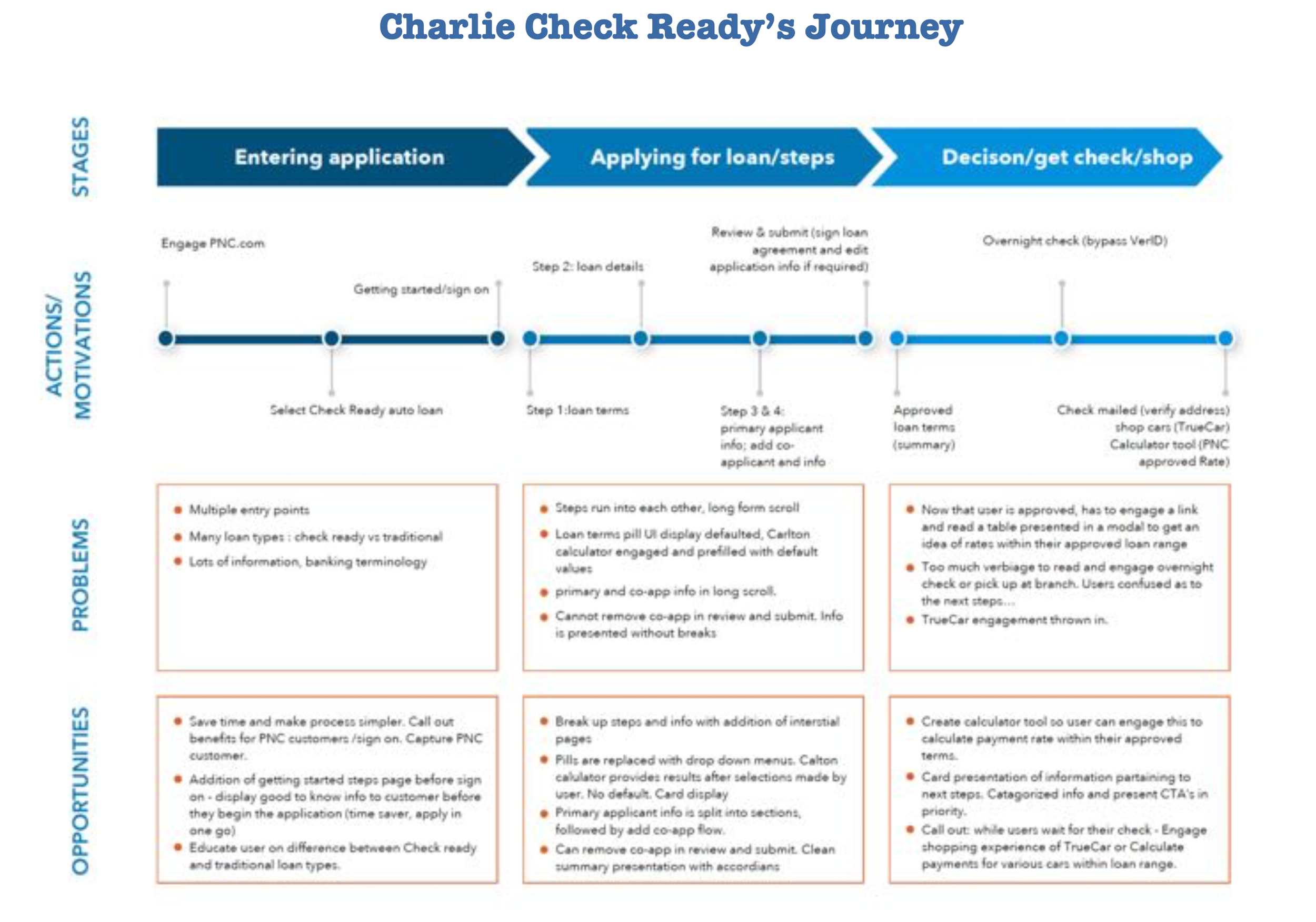

Persona journey map and task flow

🛠️ Designing the Core Product Experience

Pre-application Experience - User Avenues

Prospect (Guest) User

PNC.com, Paid Ads, TrueCarAuthenticated (Return) User

Mobile App, Online Banking, PS1 Offers

Competitor Analysis:“Bank of America puts emphasis on upfront rate information and easy application experience particularly for existing customers. Bank of America delivers shoppers to informational pages rather than straight into application from search.” - Comscore Repot 2020 (Marketing Data and Analytics)

🔍 Testing & QA Integration

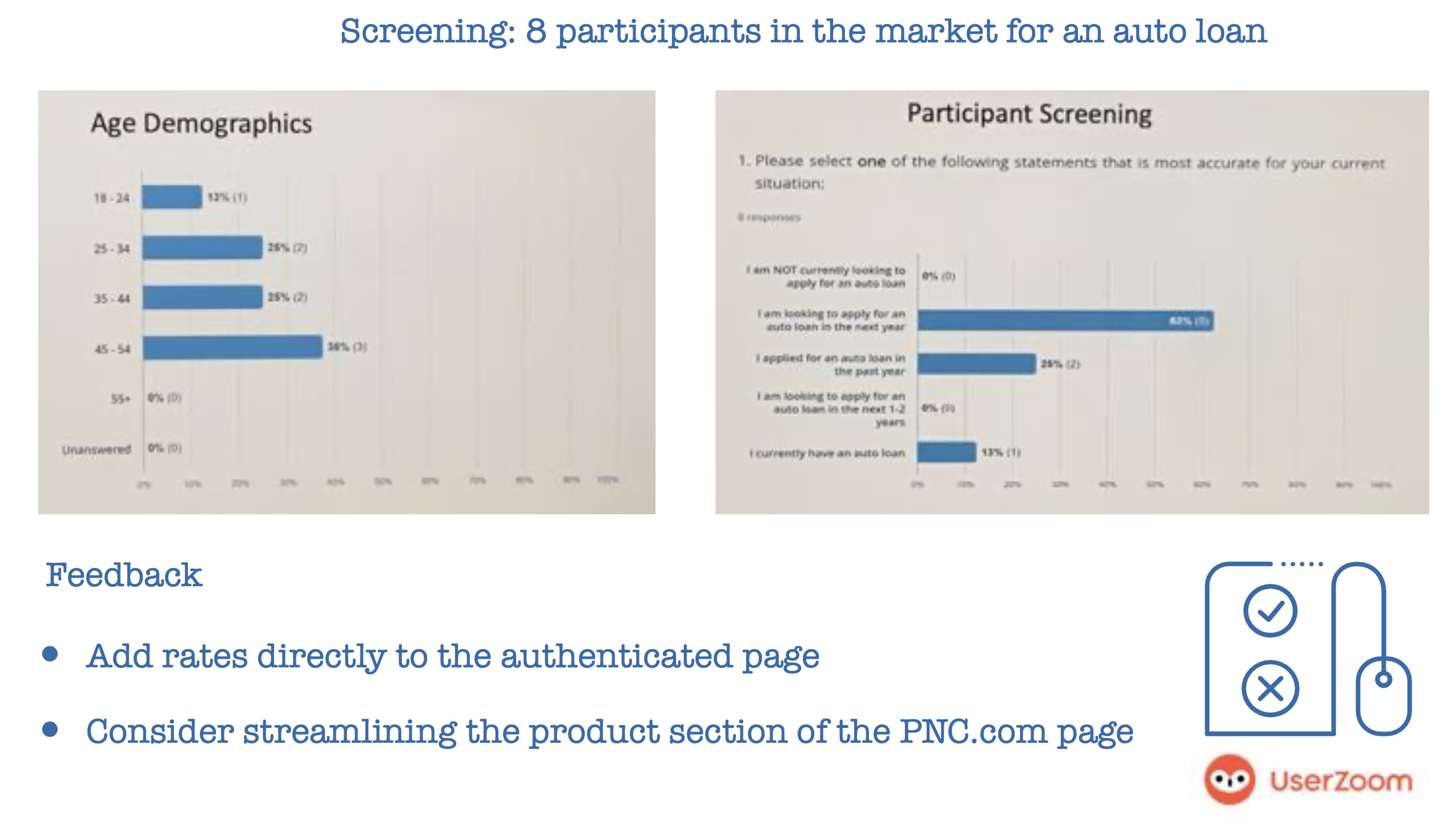

Partnered with UX Research to test prototypes with internal focus group users.

Conduct an A/B test of the two landing page experiences for auto loan shopping. (The standard PNC.com page and the page for authenticated users from online banking)

Embedded UX into QA and UAT processes for smoother validation and feedback loops.

🌐 Cross-App Ecosystem Thinking & Design

To extend value beyondjust shopping for an auto loan, I designed experiences that connected to:

Pre application experience: entry

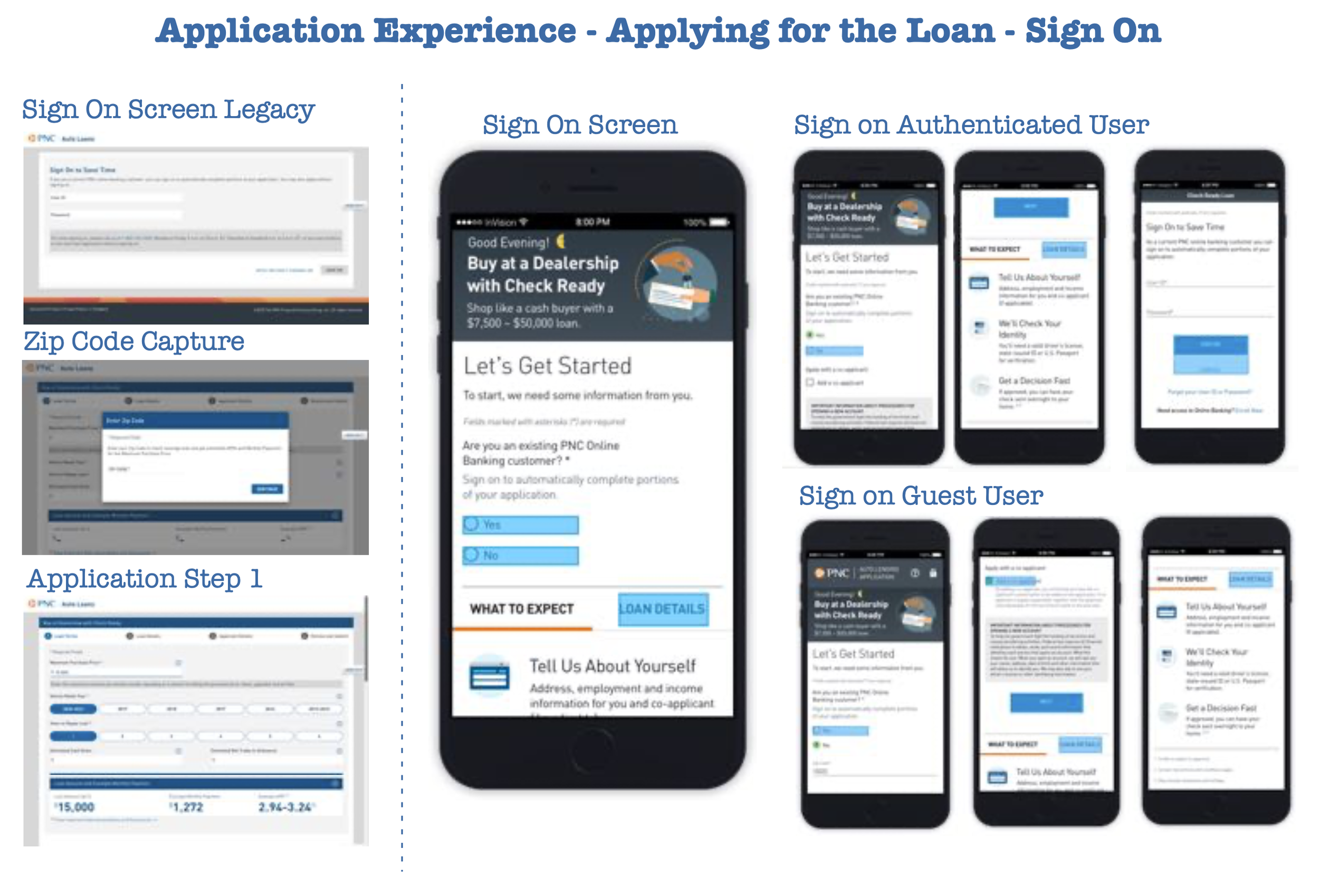

Application experience: sign on

An authenticated user: pre approvals and return clients

🎨 Design System Contributions

Led improvements to form design by organizing information into clear steps, validating inputs and error states, review and submit applications, resuming incomplete applications, marketing landing page collaborations + more

Contributed reusable components (e.g. Product definition and routes)

Influenced system rules through product-specific use cases and assisted in POCs with devs

Impact

The redesigned applications delivered a streamlined, user-friendly experience, reducing application completion time and improving customer satisfaction scores. Real-time dealer payment functionality positioned the product as a market differentiator, driving adoption and reinforcing the brand’s commitment to innovation in digital lending.

✅ MVP launched on time collaborated across banking fleets

📈 User testing validations guided product direction

🔍 Shoppers can now distinguish between the various auto lending products offered by PNC bank

🎯 Stronger product-to-platform alignment through set up and collaboration with Design Systems team

✅ Online Auto-Lending Report: - Comscore Repot 2020 (Marketing Data and Analytics)

“ PNC offers the most innovative application experience, giving customers the opportunity to pre-fill and display in application sample rates based on applicant entries for cost of the vehicle, amount of loan sought, and whether or not they are willing to auto pay out of their checking account”

Retrospective & Next Steps

Business Needs

Created Micro Apps to define each stage of the Auto Loan Process with the intent of reusability across other lending products and integrated accessibility best practices into the new design

User Needs

Distinguish clearly between product offerings Create a simple and intuitive end to end process

Scope

Incorporate and modernize all legacy features to make the end to end application experience digital. Release MVP1

Post MVP1 Enhancements

Save & Resume

Auto Loan Work Testimonials

“Taz is an exceptional hands-on UX professional. She possesses solution-oriented thinking and is a highly productive and empathetic team member. Due to her vision and understanding of digital transformation, she has delivered successful mobile and web-based products in a fast-paced, agile environment. She exhibits great leadership, communication and collaboration skills, along with rapid prototyping and iterations. In summary, Taz is a UX rock star and any organization or company would be lucky to have her”

“Taz has been a huge asset in providing her skill set and design acumen to help drive the legacy and new UI designs for the entire PNC Auto Loan incentive. This work entails daily stand-ups to provide clarity to the needs of the team and the client, providing design presentations and prototype work, plus giving her time to set up testing designs for user testing with the internal PNC Testing/Compliancy teams. Remember, this is Two Fold: Legacy and New UI Work.

Her work has focused on the desktop and mobile views, plus a push to provide visuals on tablet views as well. All of this effort has been pushed to a new high by the tandem efforts with the “entire” PNC UX Design team – this coordinated effort has paid off by her participation and contributions to the on-going design work now placed onto the Virtusa/PNC DSM – an internal Style and Pattern Guide to push the overall collaborative conformity for the on-going and new designs set by the client – and speaking of client interactions, she takes the lead in providing transparency and initiative of the on-going work, and future state of the project/s.

She has been an asset as a design lead, a colleague, a friend, all rolled up into one hard worker for Virtusa. She is self-motivated, pushing designs, providing tandem design/tech input with the Devs, and has leveled herself to be the key voice for PNC client interactions.

She’s a pleasure to work with, and a wonderful person.”